April

1995

Job Description of Administrator:

1 – Personnel Related

-

Attendance

/ Leave Record

-

Salary

Calculation & Payments

-

Personal

Folder maintenance

-

Increments

record

2 – Administration Related.

-

Timely

payment of Phone bills / Electricity bills

-

Payment

of “Tea” bills

-

Payment

of “Stationery” bills

-

Inventory

Control / Reordering of all stationary items (so we do not run short)

-

Statutory Compliances

Shop & Establishment

Act.

-

House

keeping

-

Minor

Cash Purchases (Imprest A/c)

-

Announcement

of Paid/Unpaid Holidays in advance

-

Insurance

(Cars/Computers/entire office)

-

Timely

payment of Road Taxes (for Cars)

-

Security

3 - Business – Related

-

Filing

o

Correspondence

Files

o

Biodata

Files

o

Biodata

Boxes

Job Description of a Consultant:

·

Follow-up

client (once computer print-out have been sent.) to give “dates” for conducting

interviews & names of candidates to be called

·

Prepare

interview-schedules & release to client & to “Interview-Panel Expert”

·

Get

ready Interview-Call letters & ensure timely dispatch to candidates.

·

Phone-up

candidates & obtain their confirmation / alternate dates requested.

Communicate “Status” to client every 2nd/3rd day (or even

daily) as to who/how many are attending

·

Wherever

necessary, ensure dispatch of “Registration-Forms” along with CALL-LETTERS

·

As

soon as interview-call letters are dispatched, send-out to client plastic

folder containing

-

Xerox

copies of biodatas along with Interview Evaluation sheets.

·

Follow-up

with client (if required by periodic visits)

Re:

FEED-BACK on

-

How

many/who attended

-

Who

was passed (selected) / rejected / kept on HOLD

-

Who

is to be called for FINAL INTERVIEW (if any) & when. To follow-up and

organise such final interviews.

-

Ensure

that client issues Appointment Letters to candidates “passed” in the final

interview. Follow-up and get copies of appointment letters – alternately sit

across client and fill-up “Compensation-Format” for calculation our

Professional-Fees.

·

Wherever

client is unable to select/appoint anyone in the final interview, sit with him

and decide next course of action

eg.

-

Call

some more candidates

-

Readvertise

-

Search

our Database etc.

·

Your job is not over till,

-

Relevant

INVOICES are issued

-

Payment

cheques are collected

·

Feedback

to Candidates re= “outcome” of the interviews

Today,

this is a “weak” area. We give feedback only if (and when) Concerned candidate

phone us. This is not correct.

We

owe to each candidate feedback on whether he got rejected/shortlisted for final

interview / short-listed for salary-negotiations. For this feedback, we should

call him up on our own. If he does not have a phone, we should send him a

STANDARD (but nice & polite) letter (never a post-card !)

CLIENT – RESPONSE

·

There

are many cases where we have already received “Advance (i.e. Minimum Search

Fees)” but have not acted-upon the Client’s PURCHASE ORDER, by

-

Searching

our Database

-

Short-listing

suitable candidates

-

Sending

first the “Short-list” and then individual, detailed bio-datas to the client

for his scrutiny.

We take action only when client

starts phoning ! This is creating poor image.

So first thing to do is to prepare a

COMPREHENSIVE ORDER-BACKLOG LIST

(in chronological order of the

dates)

Split this into

Which could be converted to ADVANCE, if we

had Time to attend to these (although intuitively we know that we have

in our databank, very Suitable Candidates) LOST POTENTIAL! LOST BUSINESS!! Either

because, ·

We want to start a relationship with an important client (eg. Hinduja/Finolex/Kirloskar

etc.) OR ·

We are not sure of being able to find Suitable Candidate &

create poor impression) Obviously

this is Top PRIORITY & action must be started at once, otherwise these ”orders”

will get cancelled!

Our priority for action is obviously, First

(A), then (B) & lastly (C).

You should sit-down with Nirmit, devise a

proper format and with his help (his memory) start filling-up each these lists,

starting with List (A). The format could have following columns:

-

Client

Name / Contact Person / Phone No.

-

Position

/ Vacancy

-

“Advance”

Details (cheque No./date/amount)

-

ACTION-TAKEN DETAILS

o

Computer

print-out sent-date/ (no. of records)

o

Detailed

Biodata sent-date / (no. of biodatas)

o

Interview

Arranged – date / no of candidates

o

Remarks

In the software being developed by Mr. Nagle,

there are “modules” for

-

There is a folder for each of these![]()

Order

Processing

-

Interview

Fixing / Follow up.

-

Advance

/ Invoicing / Accounting.

The formats to be used are shown in these

individual folders. All these will ultimately get COMPUTERISED. However, it

will help us – and Mr. Nagle – tremendously if we are to immediately introduce

a MANUAL SYSTEM (of “record-keeping” in Lists/Statements/Tabulations/

Registers / Formats etc.) and use it for a few months to find-out its SHORTCOMINGS/LACUNAE,

so that, when we computerize, we can take care of problems faced during

MANUAL OPERATION.

Rewriting computer software again and again is

expensive / time-consuming and throws “production” out-of-gear. This could be

avoided by trying / testing a MANUAL SYSTEM, although it could mean duplicate/multiple

entry of same data in several different FORM/STATEMENTS/REGISTERS. But this

will be a very good LEARNING-PROCESS, and will help us do a better job

of computerising with very little subsequent changes.

3/9/1993

MIS MODULE

Mgmt. Info. System

Every business must set targets (budgets) and

must measure actual performance against those target. The difference between

the two (variance) is used as a feedback to the individuals within the System

to take corrective action.

Even if it is difficult for the next ½ years to

set targets, we should, at least decide upon

-

For

which parameters we would one-day like to set the targets.

SO that

Even now, pending target setting, we already start compiling the “ACTUAL

ACHIEVEMENT / PERFORMANCE” figures for those parameters and start plotting

these graphically

In a nut-shell,

If we compile and graphically plot last 2/3

years Statistics, we would know the TREND for each item.

We

would also know inter-relationship, if any, between one parameter and

the other.

(e.g.)

A. No. of persons appointed is a function of

(or directly propositioned to)

a. Size

of databank

b. No of on-line statement sent

c. No. of bio-datas sent

d. No. of prelim-interviews held

e. No. of final interviews help

f. No.

of call-letters sent

g. No. of appli./bio-datas recd.

h. No. of clients

i. No. of pending purchase orders (order

backlog)

j. No. of Advt. released

k. No. of client inquiries

etc.

etc.

Another example

B. SIZE of Databank (Active) is a function of or

directly proportional to

1. No of mailers sent out

2. No. of “Birth-Day” greetings sent

3. No. of unabridged Annual Reports collected

4. No. of Advt. released

5. No. of Alumni Asso. Linked-up

6. No. of Companies enrolled in 3P CLUB

7. No. of Databases tapped

e.g. - Diners Club Members

-

Membership Directories of Professional bodies

8. No. of “associates” established in Various

towns

28/3/1998

DUTIES / RESPONSIBILITIES

OF

ACCOUNTANT

1. Statutory

2. Financial Accounts / Invoicing

3. Management Accounts (MIS)

4. Cost-Control

5. Budget

6. ACRA (Annual Calendar of Repetitive

Activities)

7. Insurance / Renewal

8. Purchase & Payments

9. Salary Payment / Attendance

STATUTORY

·

Timely

payment of Income tax (Company as well as family members)

·

Filling

of Income Tax Returns.

FINANCIAL ACCOUNTS

·

Prepare

vouchers for all purchases and make payment after comparing / checking

-

Purchase

order (Qty / Price / Value / Serial no. of eqpt. Delivered/commercial terms/

taxes etc.)

-

Delivery

challan

-

Vendor

Invoice

·

Raise

Invoice for all executives appointed. Follow-up till money received. Raise

Debit/Credit notes. Out-of-pocket expense invoices.

·

Preparation

of monthly P&L a/c

·

All

banking matters (deposit/issue of cheques, pass books, fixed deposits, tallying

bank statement with our internal records etc.)

·

OUT-OF-POCKET

EXPENCES (OOP)

We

are supposes to

Oop

from our clients by

Appropriate

monthly invoice

This

arrangement is cart of our TERMS

Main OOP are

A.

Courier

charges (call letters/interview letters)

B.

STD/ISD

phone charges (very frequents)

C.

Outstation

travels (occasionally)

Outstation travel are only

undertaken by Nirmit – so whose (which client) behalf & how much did he

spend. He can fill-in a simple form, attaching supporting vouchers.

I believe “Courier Charges” are

being compiled reasonably well. Pl- check. Can this record be computerised ? Discuss with Sajida.

Biggest chunk is STD charges for which

TELESOFT Software has been installed for over 6 months now. There were some

“hitches”, Are these sorted out? Is software still “clumsy” ? what happens if

operator forget to enter a few STD calls daily? Do we have a fool-proof method?

If not stream-lined, this is one area where we could lose lakhs of rupees

annually!

When we get MTNL’s STD bill at the

end of each month, & discover “unaccounted” STD calls, it is too late to

remember & reconcile!!

FIXED ASSET REGISTER

|

Asset No: |

Depreciation Rate: |

||||

|

Asset

Name / Description: |

|||||

|

Asset Category |

|

||||

|

Manufacturer: |

Model: |

||||

PURCHASE DETAILS

Name of

Supplier :

Add. Of ‘’

:

Phone of ‘’(O) : Fax

No.:

(R) : e-Mail:

Contact

Personas :

Purchase

order No : Order Date:

Supplier’s

Dely. Challan No: Date:

![]() Supplier’s Invoice No : Date:

Supplier’s Invoice No : Date:

![]()

![]()

![]() Purchase Price (inc. of taxes/octroi) Per Piece (Rs) Qty (no) Total

Value (Rs)

Purchase Price (inc. of taxes/octroi) Per Piece (Rs) Qty (no) Total

Value (Rs)

Product

Serial No:

![]() Guarantee / Warranty:

Guarantee / Warranty:

![]() Intimated to Insu. Company (for

inclusion) on (date)

Intimated to Insu. Company (for

inclusion) on (date)

DEPRECIATION – SCHEDULE

|

As on |

Opening Book-Value |

Depreciation Amount |

Year-end Book-Value |

|

1 April ---------- |

|

|

|

|

1 April ---------- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In Case

Asset Scrapped:

Book Value:

Realised

Value:

Date:

MANAGEMENT

ACCOUNTS (MIS)

·

Prepare

monthly/Quarterly/annual/budgets

-

Capital

budgets

-

Manpower

/ Salary budgets

-

Revenue

expenditure budgets

-

Sales

Invoicing budgets

& Compare Budget Vs. Actual, find “Variances”

(& Causes) & modify budget for balance period.

Maintain / update 3 month rolling budget.

·

Use

rolling “Cash Inflow/outfeeds statements to alert Nirmit

Re:

-

Surplus

funds (and possible short term/long term deployment)

-

Shortage

of funds ( and suggestions on where to borrow from temporarily)

COST

CONTROL (MIS)

·

Prepare

list of

-

Cost

Centres

-

(Cost)

Account Heads.

Setup a System to compile “Costs”

against each.

·

Develop

“Cost-trends” from historical data and use these trends for future projections

for the budget preparation Cash outflow statements.

·

Cost-Variance

analysis

-

Quantity

(Consumed) Variance

-

Price

Variance

for every “account-head”

·

Suggest

corrective-action to bring costs under control.

INSURANCE

We have to

ensure that each Insurance policies are (Value) updated every 3 months and

renewed every year.

These

policies should cover

|

|

FIRE |

Threat |

|

Office Premises including

furniture cabins. |

ü |

|

|

Computers & other office eqpt.

H/W |

ü |

ü |

|

Vehicles (Cars) |

|

ü |

PURCHASE

& PAYMENT

We buy

-

Computer

H/W.

-

Other

office eqpt.

-

Software

-

Software

maintenance (contract) Services

-

H/W

Maintenance Services (yet to start)

-

Stationery

(general)

-

Stationery

(Computer)

-

Consumable

(Computer)

-

Consumable

(general)

-

Maintenance

contracts for

o

EPABX

o

PEST

Control

o

Copier

Etc.

-

Telephone

bills

-

Electricity

bills

-

Society

bills (Muni-Taxes

-

Society

bills (Maint./Charges)

-

Newspapers/Magazines/Subscriptions

-

Repair

bills

-

Insu.

Premium

-

Taxes/rents

All the above must be paid on time / must be

budgeted/must form part expected cash flows.

Rule is “NO SURPRISES EVER!”

SALARY PAYMENTS / ATTENDANCE

A computerised “Personal Folder” must be created

for each & every employee, giving his joining salary & annual increements

and new salary on 1st July of each year.

For each month, depending on no. of working

days (including paid holidays), DAILY SALARY should be worked out for each

employee.

To multiply by “no. of days worked” to arrive

at monthly salary payable.

A Computer software is already installed for

this.

All employees to be issued Appt. Letters ?

(check with Salil Gandhi first.)

All employees to be allotted a PS No. (Pay-sheet

no.) & issued plastic ATTENDANCE- RECORD CARD after entering the “PS No.”

& “Full Name” & “Monthly Salary” data into the concerned software.

We may create physical folders (pieces of

papers) – one for each employee – to begin with and after using for A/C/ months

and gaining experience, change over to ELECTRONIC (COMPUTER-BASED) FOLDERS thereafter.

I have already prepared a folder & given to Sheetal.

FAMILY

ACCOUNTS & FINANCIAL MATTERS

·

No./Name

of each family member

·

For

each family member, compile,

-

Bank

Accounts (current / Savings/NSS/PPF etc.)

-

Fixed

Deposits

-

Shares

-

Units

-

Other

types of Investments / Current assets.

-

LIC

Policies

-

Mediclaim

-

Fixed

Assets (Car/Land/Flats etc.)

·

Prepare

for each member

·

Yield

chart

·

Renewed

chart

·

Premiums

/ Interests to be received month-wise & actual receipts. Follow-up non-receipts/late

receipts

·

Pay

personal bills (thru cheques) & deposit all cheques received & keep all

bank accounts up-to-date.

·

Prepare

individual CASH-FLOW charts to decide upon deployment of surplus fund

·

File

personal (Income-tax Wealth-tax) returns on times

DAILY

·

Bank

balance in all accounts must be cheeked & tallied daily with the cheques

issued/received and the Passbooks.

·

All

entries in software package “TELLY” must be up-to-date. There should be no

backlog at the end of the day.

·

“Imprest”

account book should be up-to-date. Only persons authorised by Nirmit should be

able to operate imprest a/c. In each individuals case upper/max limit must be specified

and a/c must not be replenished without first clearing old earlier withdrawals

by submission in proper vouchers/bills.

·

Electricity

Bills/Water Bills/Phone Bills/Society Bills etc.

These must be paid before the due date to appropriate authorities

& wherever possible recipient’s signature be obtained on the counterfoil.

For each of these payments a running-record (month-wise) must be maintained on computer,

so we know at a glance, when exactly each month’s payment was made along with

bill no./bill amt/cheque no. etc.

DAILY

OUTSTANDING

FOLLOW-UP

·

One,

very important daily activity shall be the follow-up of our clients and

collection of all outstanding payments. This has to be done/carried-out

vigorously (but quite politely although persuasively).

As soon as

o

An

invoice is released

o

A

payment cheque is received it should get posted on computer & the software

must instantaneously “rework/recast” the

CUSTOMER OUTSTANDINGS

STATEMENT

In

o

Chronological

order and

o

Descending

order of Amount wise

This

statement (auto generates) should have following details:

-

Customer

Name / Ph/Fax/Email

-

Contact

Person Name / Desig/Ph.No.

-

Assignment

/ Customer order No. & date

-

Position

filled / Person appointed

-

Invoice

No./date/Amount (less Adv & Not payable

-

Date

due / No. of days overdue

-

Details

of past promises made etc.

If a

particular client owes us amounts against several assignments (several

invoices), the Software should be capable of auto-generating client-wise

outstanding statements (in descending order of value) which, accounts officer, should

send out attaching a STANDARD covering-letter by

-

Email

-

Snail

mail (print-outs).

Depending

upon the last time/date on which such a previous statement was sent to a given

customer, the Account officer, will decide when to send-out the next statement.

Software

must keep track of

-

All

past statements sent to a client (date-wise)

-

All

phone-calls made (date-wise) & “promised” date.

On the “promised”

date, a screen should automatically POP-UP as a reminder to Accounts

officer to follow-up.

Clicking on

client Name should connect Acct. officer to client.

D/1

OUTSOURCING OF

ACCOUNTS – FINACE & RELATED

FUNCTION

DAILY

ACTIVITIES

·

Preparation/entry

of all expense vouchers

·

Preparation

/ entry of all Cheques

Cheques should be made as per credit terms agreed-upon by suppliers.

No post-dated cheques must be issued without prior ok from Nirmit

All inward (receipts) cheques must be deposited in Bank A/c on the same

day.

All cheque-booked must be kept under lock & key. Same for

pass-books, pay-in-slips and all accounts/finance related documents.

No cheque payment must be made without a Purchase order (Po) (whether

typed or emailed).

There must be a PO for goods or services, for which separate PO

numbering Serial should be developed.

No payment should be made (whether by cheque or by cash) unless relevant

“GOODS/ SERVICE RECEIPTNOTE” is duly signed (for receipt) by the person who has

received it.

MIS M/4

MONTHLY

·

Preparation

of rolling (next 3 months)

Cash Inflow / Cash outflow statements based on

“NEXT 3 MONTHS FORECAST” STATEMENT

Each consultant must fill-in figures relevant to his/her activity ONLINE

(on our intranet).

By adding-up each individual Consultants “forecast), a consolidated

COMPANY-WIDE statement could be prepared to find-out if our cashflow position

would be satisfactory.

It would permit us to deploy surplus cash (in instruments such as

short-term FD’s etc.) and earn interest.

These “forecasts” must not be confused with monthly/quarterly/annual “budgets/targets”.

Monthly “Performance Comparisons” (budget Vs. Actuals & variances) shall be

only with respect to BUDGETS & TARGETS & not with respect to these

“rolling” forecasts, which are made, strictly for one purpose viz. to

figure-out CASH-FLOWS & manage liquidity/payment issues.

M/3

3/9/2000

(Budget Vs. Actual-Cont.)

Such detailed, individual

Consultant-wise BUDGETS/TARGETS must be “published” on our Intranet in a

transparent manner (for everybody) to see at any-time. This must be done at the

beginning of the year as also when each new Consultant joins.

Ideally, the appointment letter

issued to each Consultant should contain his/her “Performance Targets” and the

“Incentive Scheme” applicable to him/her.

Monthly “Variance” statements (for

the whole Company as well as for each individual consultant) must be

posted on corporate intranet for everybody to see. Such transparency boosts

employee moral since everyone knows that there in no “adhoc-ism/ favouritism”, and

that same “rules” apply uniformly to everyone.

With second quarter coming to an

end, we must hurry-up with formulation/framing of all budgets/targets” for 3rd

& 4th Qtr. And publish the same by 20/9/2000

M/2

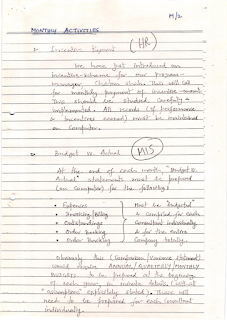

MONTHLY ACTIVITIES

·

Incentive Payment (HR)

We have just introduced on

incentive-scheme for our program-manager Chetan Shah. This will call for

monthly payment of incentive-amount. This should be studied carefully &

implemented. All records (of performance & incentives earned) must be

maintained on Computer.

·

Budget vs. Actual (MIS)

At the end of each month, “Budget

vs. Actual” statements must be prepared (on Computer) for the following:

Must be “budget” & Compiled for each

Consultant individually & for the entire Company totally.

o

![]() Expenses

Expenses

o

Invoicing

/ Billing

o

Outstanding’s

o

Order

Booking

o

Order

Backlog

Obviously, this (Comparison/Variance

statement) would require ANNUAL/ QUARTERLY/ MONTHLY BUDGETS to be prepared at

the beginning of each year, in minute details. (with all “assumptions” explicitly

stated) These will need to be prepared for each Consultant individually.

M/1

MONTHLY ACTIVITIES

·

Salary Payments / Retainership Payments

From appointment letter/retainership

letters, all salary + perks details must be entered into relevant software

Details of authorised leave (with

pay/without pay) must be entered from the leave-cad on daily basis, so monthly

deduction can be computed automatically by the Software. For this purpose

salary/retainership payments must linked with “ATTENDANCE” System. Monthly

“Salary-Slips” must get automatically printed-out.

I suppose “TELLY” has built-in

“PAYROLL ACCOUNTING” feature.

Timely payment of

Salary/retainership is an important monthly routine.

All Salary payments must be made by

cheques only.

If all employees agree to open personal

accounts in Saraswat Bank, it should be possible to effect a CONSOLIDATED

payment to the bank rather than issuing individual cheques to employees. This should

be seriously explored & implemented. It will save a lot of time/effort

& ensure timely crediting of each employee’s account.

P/1

PERIODIC ACTIVITIES

These will Comprise:

·

Timely

renewal of all Insurance Policies

o

Office

(bldg. + eqpt.) insurance (fire/theft burglary etc.)

o

Car

Insurance

o

Mediclaim

(for staff)

·

Timely

renewal of all “Contracts”

o

HW

maintenance

o

Telecom

“

o

Pesticide “

o

Photocopying “

o

Electrician

o

Stationery

Supplies (rate contracts)

o

Website

maintenance (?)

o

Outsourcing

of “Accounts”

o

ATS

(Annual Technical Subbort) for Software’s (e.g. Oracle database) POSTMASTER

etc.

o

Attendance

Recording System

o

Fire

Protection Eqpt maintenance

o

Z-COP

Security

o

Web-Server

(Digital Nation)

o

Website

domain-name renewals)

o

Virtual

Private Network (VPN)

A/1

ANNUAL ACTIVITIES

·

P&L

Statement/Balance sheet, preparation

·

Income

Tax Returns filing

·

Preparation

of next year’s Annual Budgets/Targets & release to all

(for whole company & each individual

covered by any incentive-scheme)

![]() STATUTORY ACTIVITIES S/1

STATUTORY ACTIVITIES S/1

·

Payment

of TDS

·

Payment

of Professional Tax

Prof job

·

Payment

of Income Tax (Corporate)

·

Payment

of Service Tax

·

Payment

of PF

6/9/2000

ROTING ACCOUNTING

|

ACTIVITY |

FREQUENCY |

||||

|

Daily |

Monthly |

Qtrly |

Periodic |

||

|

1 |

Preparation &

entry of all expense vouchers in computer |

ü |

|

|

|

|

2 |

Preparation &

entry of all cheques along with Supplier’s Invoices/GRN/Challans etc. |

ü |

|

|

|

|

3 |

Entry of all

Purchase order released by us on Suppliers |

ü |

|

|

|

|

4 |

Entry/bank

depositing of all cheque-payments recd from client with invoice details |

ü |

|

|

|

|

5 |

Daily

reconciliation/verification of Cheque Book /Pay-in slip / Pass-book/Bank

balance |

ü |

|

|

|

|

6 |

Maintenance of “imprest

a/c & tally with “Cash-on-hand” |

ü |

|

|

|

|

7 |

Timely payment of

all bills (water/electricity/society/phone/supplies/service etc.) |

ü |

|

|

|

|

8 |

Preparation &

Despatch of all Invoices (to clients) as per data given by concerned consultants |

ü |

|

|

|

|

9 |

Follow-up of each

& every invoice, one week before due date/Vigorous follow-up till full

payment is received, based on CUSTOMER OUTSTANDING STATEMENT |

ü |

|

|

|

|

10 |

Preparation of Client-wise

“Out of Pocket Expense” Statement “ “ “ “ “

Invoices & despatch |

|

ü |

|

|

|

11 |

Follow-up of OOP

Invoices Payment |

ü |

|

|

|

|

12 |

Renewal of all

Insurance Policies (Office-eqpt-car-mediclaim etc.) |

|

|

|

ü |

|

13 |

Alerting &

following up with concerned/responsible persons for timely renewals of all “Service-Contracts”,

before expiry date in each case |

|

|

|

ü |

|

14 |

Monthly trial

balance / P&L statement |

|

ü |

|

|

|

15 |

Monthly actual

expense statement (item-wise) |

|

ü |

|

|

|

16 |

Filing of Income

Tax Returns (Co’s & Family members) |

|

|

|

ü |

|

17 |

Timely payment/deposit

of TDS/Prof-Tax/IT/Service Tax/PF/any other statutory levies |

|

|

|

ü |

|

18 |

Timely payment of

Salaries / retainerships/incentives to all staff (as per attendance) |

|

ü |

|

|

|

19 |

Timely renewals of

all FD’s/creation of new FD’s |

|

|

|

ü |

|

20 |

Maintenance of

Fixed Assets Register |

|

ü |

|

|

Note:

Routine accounting will cover 3P/Income & all family members.

6/9/2000

FINANCIAL / MANAGEMENT ACCOUNTING

MIS

|

ACTIVITY |

FREQUENCY |

||||

|

Daily |

Monthly |

Quarterly |

Periodic |

||

|

1 |

Development of

Cost-Centres & Cost-Trends |

|

|

|

|

|

2 |

Compile / Tabulate

“actual expenses” incurred during last 2 years (Cost-centre wise) |

|

|

|

ü (Ann) |

|

3 |

Compile / Tabulate

“actual invoicing” “

“ (several ways) |

|

|

|

|

|

4 |

Develop “NORMS” for

“expenses” based on Ø

Staff strength > Area > No. of persons appointed > No. of

computers > No. of telephone lines > No. of consultants > No. of

clients > No. of shopping baskets > No. of Advts |

|

|

|

ü(Ann) |

|

5 |

Develop a set of

“ASSUMPTIONS” for each cost centre/staff member who is likely to “incure”

expenses or “achieve” billing targets |

|

|

|

ü(Ann) |

|

6 |

Develop

“ANNUAL/QUARTERLY/MONTHLY” budgets (for

expenses) targets (for

achievements/billing) |

|

ü |

ü |

ü (Ann) |

|

7 |

Prepare “Budget Vs.

Actual”/”Variance” statements (for expenses/invoicing/collection/customer

Outstanding/appointments/partners signed-up/ resumes received / shopping

baskets recd/interviews conducted/proposals submitted etc.) To be done monthly

(Qty variance/price variance/Assumption-variance) |

|

ü |

|

|

|

8 |

Develop 3 monthly

rolling forecast for “CASH INFLOW/OUTFLOW” |

|

ü |

|

|

|

9 |

Prepare month-end “ORDER

BACKLOG” statement (Industry wise/Function-wise/Desig. Level wise/Client

wise/Consultant wise) |

|

ü |

|

|

|

10 |

Same as above,

prepare, monthly ·

ORDER BOOKING statement ·

Invoicing “ ·

Collection “ |

|

ü |

|

|

|

11 |

Client-wise,

chronological, Invoice History/ Payment Receipt History |

|

|

|

ü As when required |

|

12 |

Supplier-wise, chronological,

Bill History/Payments made history. |

|

|

|

|

No comments:

Post a Comment